A chart of accounts is a catalog of account names used to categorize transactions and keep your business’s financial history organized. There’s often an option to view all the transactions within a particular account, too. Small businesses may record hundreds or even thousands of transactions each year.

Accounts numbering in the chart of accounts

For example, if you rent, the money will move from your cash account to a rent expense account. A chart of accounts is a critical tool for tracking your business’s funds, especially as your company grows. Without a chart of accounts, it’s impossible to know where your business’s money is. The chart of accounts is like a map of your business and its various financial parts.

- Understanding these types can help businesses choose or design a COA that best fits their accounting requirements.

- A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

- Because the chart of accounts is a list of every account found in the business’s accounting system, it can provide insight into all of the different financial transactions that take place within the company.

- A chart of accounts, or COA, is a list of all your company’s accounts, together in one place, that is a part of your business’s general ledger.

Account Numbering System: A Key Aspect of the COA’s Structure

By ensuring it is well-organized, logically structured, and fully integrated with accounting software that supports real-time data processing and analysis. Ensure the COA structure is compatible with the software, use standardized account numbers and names, and regularly review the integration for any updates or changes in business processes. Regularly back up your data and perform test runs before finalizing any changes or updates to the COA within the accounting software.

Streamline your accounting and save time

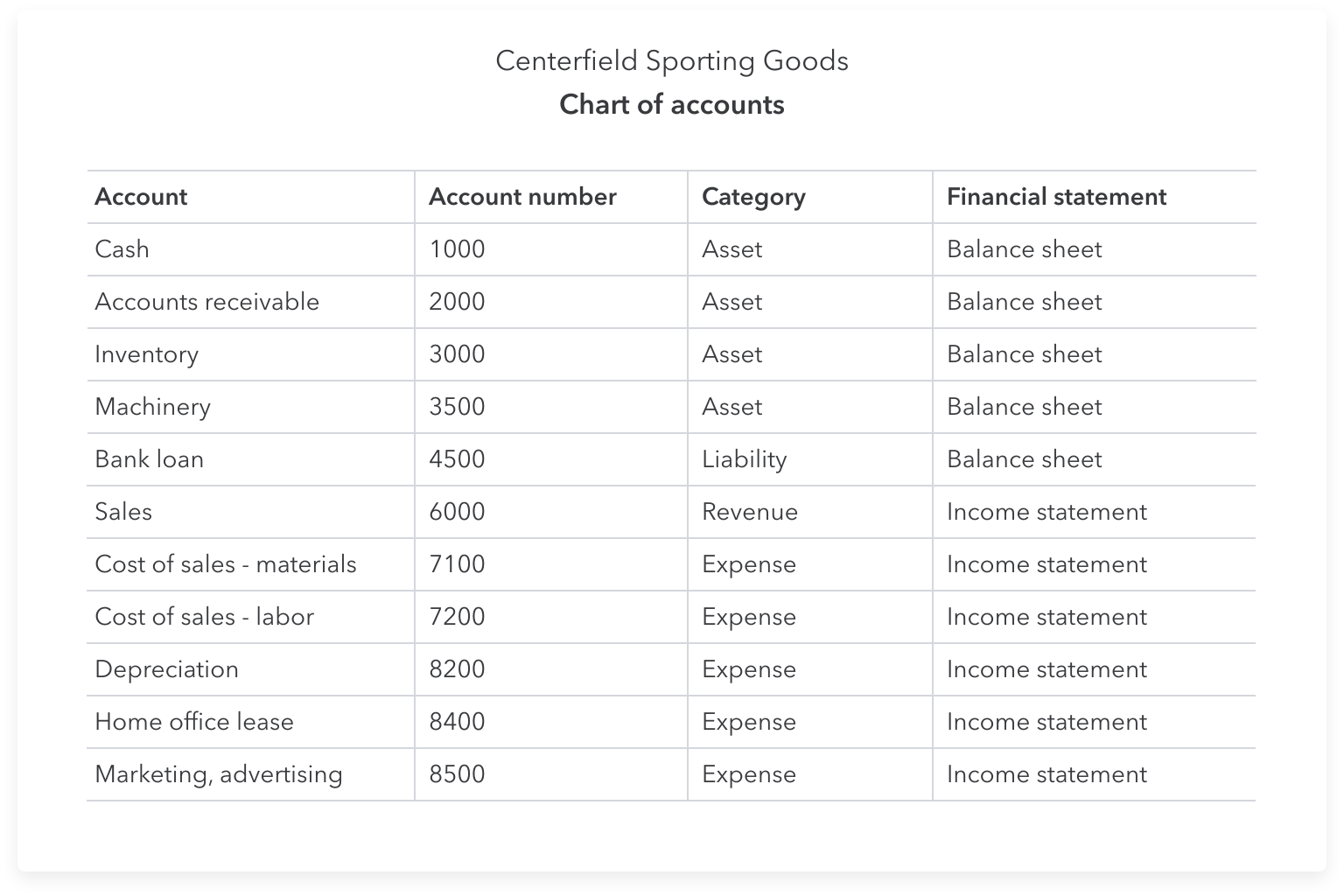

This includes adding accounts specific to your industry or operational needs. Ensure that the numbering leaves room for additional accounts to be added as the business grows. Under each main category, there can be several sub-accounts to provide more detailed tracking. The accounts are identified with unique account numbers, and are usually grouped according to their financial statement classification.

How can a COA help drive my business decisions?

As businesses grow, these technologies can adapt to changing needs, such as incorporating new accounts or modifying existing ones, thus offering scalability. Moreover, technology streamlines the audit process by organizing financial data in an easily accessible manner for auditors. Finally, through advanced analytics, technology can offer insights for further optimization of the chart of accounts, identifying trends and areas for improvement.

Best Online Bookkeeping Services of 2024

A chart of accounts (COA) is a comprehensive catalog of accounts you can use to categorize those transactions. Ultimately, it helps you make sense of a large pool of data and understand your business’s financial history. This numbering system helps bookkeepers and accountants keep track of accounts along with what category they belong two. For instance, if an account’s name or description is ambiguous, the bookkeeper can simply look at the prefix to know exactly what it is. An account might simply be named “insurance offset.” What does that mean? The bookkeeper would be able to tell the difference by the account number.

Back when we did everything on paper, or if you’re using a system like Excel for your bookkeeping and accounting, you used to have to pick and organize these numbers yourself. But because most accounting software these what is the difference between short term and long term debt days will generate these for you automatically, you don’t have to worry about selecting reference numbers. Revenue accounts keep track of any income your business brings in from the sale of goods, services or rent.

The role of equity differs in the COA based on whether your business is set up as a sole proprietorship, LLC, or corporation. This would include Owner’s Equity or Shareholder’s Equity, depending on your business’s structure. The basic equation for determining equity is a company’s assets minus its liabilities.

The chart of accounts, at this point, serves as a structure under which the general ledger operates. The chart of accounts (COA) is a list of accounts a company uses to record its financial transactions. It’s a fundamental accounting framework you use to organize your financial records and build reporting around. A chart of accounts gives you great insight into your business’s revenue beyond just telling you how much money you earn.

Financing through long-term liabilities allows a business to manage its immediate cash flow needs while planning for its long-term strategy. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping.