FREMONT, CA — Sales tax rates increased a percentage point in Alameda County on Thursday, bringing the countywide tax rate to 10.25 percent from 9.25 percent. Fremont City follows the California state sales tax law, as it’s located in California. There are no separate nexus rules specifically for Fremont City other than the California state tax law.

- It’s also important to note that some cities in California – San Francisco included – have some of the highest reported rents in the country.

- Even so, you should account for around $1,763 per month for full-time daycare.

- The Bay Area is notorious for luxurious dining options and heavy use of food delivery apps.

- The area demands a high price tag for this service because Fremont’s population is notably wealthier than most.

- Simply enter an amount into our calculator above to estimate how much sales tax you’ll likely see in Fremont, California.

Full list of California cities

This amount isn’t actually that much higher than other, less expensive locations, and the price may drop as your children advance in age and require less extensive supervision. Even so, you should account for around $1,763 per month for full-time daycare. Fremont has no shortage of options for childcare centers, with nearly 200 situated locally.

Fremont, California Sales Tax Rate 2024

With local taxes, the total sales tax rate is between 7.250% and 10.750%. Fremont City’s 10.25% sales tax rate is among some of the highest sales tax rates in California. It is only 0.50% lower than California’s highest rate, which is 10.75% in places like Hayward City.

California Sales Tax Rates: Fremont

The general sales tax rate in Fremont, California is determined by a combination of state, county, and city tax rates. The average cumulative sales tax rate in Fremont, California is 10.45% with a range that spans from 10.25% to 10.75%. These figures are the sum of the rates together on the state, county, city, and special levels. Despite the high housing prices, Fremont homeowners enjoy a property tax rate that is lower than the national average.

Discover our all-inclusive, full-stack sales tax solution and learn how TaxHero can support your business.

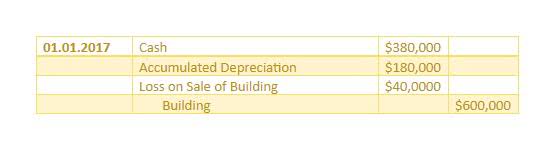

Please verify all rates with your state’s Department of Revenue before making any financial or tax decisions. High housing prices for basic family recording transactions homes will make it difficult for the average buyer to enter the market, so think twice about moving to Fremont unless you can rake in big money. Food is the area of your budget that can either make or break your living expenses.

- This method allows you to choose multiple rates based on your specific needs.

- The applicable sales tax rate may vary depending on the type of purchase (e.g., goods, services, or special categories).

- Fremont City follows the California state sales tax law, as it’s located in California.

- If you move to Fremont, you’ll never balk at the cost of utilities, even though your wealth dissipates significantly for the cost of a home.

- Despite the high housing prices, Fremont homeowners enjoy a property tax rate that is lower than the national average.

- Check out our list below of common activities in Fremont and how much they cost.

Entertainment Costs in Fremont, California

Supporters argued that the revenues generated would provide much-needed funding for critical programs to improve the quality of life in Alameda County. Most towns and cities in California have their rates somewhere in the middle, like Modesto City, which has a sales tax rate of 8.88%. If you make retail sales in California subject to the state sales tax from a business located in a taxing district, district sales tax is generally due on your sales of tangible personal property. To help you identify the correct sales tax rate in Fremont, you may look up the sales tax rate by address and ZIP code in our calculator.

Simply enter an amount into our calculator above to estimate how much sales tax you’ll likely see in Fremont, California. Afterwards, hit calculate and projected results will then be shown right down here. Fremont, CA is blessed with great weather, tons of entertainment and culture options, and hundreds of excellent jobs for motivated tech workers. If you have what it takes to hack it in the competitive tech field, Fremont could be a good place to call home. Elon Musk’s Tesla factory is the largest employer in Fremont, with over 13,000 workers. There are also numerous tech companies in the city, led by Lam Research and Western Digital, large players in semiconductors and hard drives and storage, respectively.

- With the additional county and city sales tax rate of 2.0%, this brings the total sales tax rate in Fremont, California to 9.25%.

- Fremont City is located in Alameda County in California, United States, and has a sales tax rate of 10.25%.

- We’ll walk you through how the sales tax rate is determined for Fremont City and address some common questions you may have.

- Elon Musk’s Tesla factory is the largest employer in Fremont, with over 13,000 workers.

Look up sales tax rates in California by ZIP code with the tool below.Note that ZIP codes in California may cross multiple local sales tax jurisdictions. California is known for having the highest base sales tax in the country, at 7.25%. Though, only a quarter of the cities in the state have this rate, as each local government can impose their own tax rate in fremont ca taxes on top of that.

This will make it challenging for young professionals and families to join the Fremont community. There’s no question that roommates or significant others are an absolute necessity to lower the rent burden. The livable wage in Alameda County (where Fremont is located) amounts to about $21.88 per hour for a https://www.bookstime.com/ single adult. This huge gap in livable versus minimum wage signals how unaffordable Fremont can be for the average person. Plus, we’ll share the best solution that will ensure you are always compliant across the entire sales tax lifecycle. Sales Tax States shall in no case be held responsible for problems related to the use of data and calculators provided on this website.